Key Precinct-Level Analysis Takeaways:

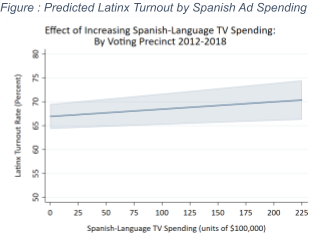

- Precinct-level turnout analysis suggests that increased Spanish language advertising in a media market predicts significantly and substantially increased Latinx turnout.

- Immigration-related Spanish advertising spending predicts significantly higher Latinx turnout at the precinct level, while English language immigration-related advertising does not.

Key Market-Level Analysis Takeaways:

- Market-level synthetic control analyses show that in nine of the ten markets experiencing the largest relative growth in Spanish ad spending from 2016-2018, Latinx turnout increased—from 3.9% to 14.5% above the synthetic control case.

- These effects were particularly pronounced in markets located in the Southwest and California, as all seven of these treated markets experienced increased 2018 Latinx turnout over their synthetic comparison cases (although not always significant increases).

- Similarly, analysis of 18 additional markets showed the largest increases in 2018 Latinx turnout (except for Miami) occurred in markets located in Texas and California.

Research Question and Design:

TargetSmart was tasked with evaluating the effect of Spanish-language political advertising on turnout among Latinx voters. An extensive political science literature has examined a series of closely related questions, with inconclusive results. This is likely due in large part to a fundamental methodological challenge facing researchers: campaigns are likely to advertise more heavily in markets in which they expect their spending to be effective. Thus, simply pooling observations across all markets and comparing Latinx turnout in higher-spending markets to that in lower-spending markets (whether using descriptive statistics or regression) may produce misleading results. In the ideal case, researchers would be able to randomly assign some markets to receive Spanish-language political advertising and others to receive none. Obviously, this is impossible. As a result, TargetSmart adopted a two-fold research design that employs the best-available methodology short of random assignment.

First, precinct-level TargetSmart ElectionBase turnout data was combined with aggregated1 individual-level TargetSmart VoterBase demographic data and Kantar Media CMAG advertising data aggregated to the media market level to conduct a panel regression analysis. Voting precincts are the smallest units in which voting data can be measured, maximizing the variation available for analysis, while using a panel regression estimator adjusts for precinct-level idiosyncrasies (e.g., local political culture) that cannot be directly observed, while also controlling for precinct-level demographic factors like race and ethnicity, gender, income, and education. This analysis is based on data from 80,249 voting precincts in 83 separate media markets, as defined by Nielsen designated market areas (DMAs).

Second, to generate estimates of the effects of increasing Spanish advertising spending in individual markets, TargetSmart adopted the method of synthetic controls. Developed by Harvard economist Alberto Abadie and his colleagues2, this method is emerging as the gold standard in non-experimental program and policy evaluation studies. Synthetic controls are used to generate a composite comparison case for each media market and are analogous to a medical trial where patients are randomized into treatment and control conditions. Because markets cannot be randomly assigned to increased Spanish advertising spending, TargetSmart identified the markets with the greatest proportional increases in Spanish language political advertising spending from 2016 to 2018 and constructed comparison cases using all available data from markets that did not experience substantial increases in analogous spending over the same period. This method allows researchers to recover market-specific estimates of the effect of increased Spanish advertising spending on Latinx turnout, using data from the top 100 US media markets by Latinx TV-viewing households (as measured by Nielsen in 2016).

Research Findings:

Precinct-Level Panel Regression Analysis:

Findings from these analyses are summarized in Figures 1-2. On average, across 83 markets, Spanish-language political advertising spending is a statistically significant predictor of increased Latinx turnout in Congressional elections from 2012-2018. In substantive terms, a $1 million increase in Spanish advertising spending in a given media market predicts a mean increase of 0.15 percentage points in Latinx turnout at the precinct level. Notably, English-language ad spending does not predict significantly increased Latinx turnout at the precinct level. Moreover, as shown in Figure 2, immigration-related Spanish advertising spending also predicts significantly increased Latinx turnout at the precinct level, while analogous English-language advertising spending does not.

Market-Level Synthetic Controls Analysis:

Using Kantar Media/CMAG data, TargetSmart identified ten media markets (Austin, Dallas, Atlanta, Albuquerque, Washington DC, El Paso, Laredo, Fresno, Tampa, and Los Angeles) that experienced the largest relative increases in Spanish-language political advertising spending between 2016 and 2018. These markets were classified as “treated”. Demographic, political advertising spending, and turnout data from 70 “donor pool” markets—those that did not experience substantial increases in Spanish-language advertising spending—were used to create matched synthetic control cases for each treated market. This methodology allows researchers to simulate a randomized controlled trial using observational data.

Nine of ten treated markets showed growth in Latinx turnout compared to their synthetic comparison cases, with all showing increases of at least 3.9 percent relative to the synthetic control in 2018. Moreover, all seven treated markets located in the Southwest and California (Austin, Dallas, El Paso, Laredo, Albuquerque, Fresno, and Los Angeles) showed increased Latinx turnout compared to their matched synthetic control markets. TargetSmart then applied a “placebo test” to each treated market to provide a measure of confidence that observed results are not due to random chance or artifacts of the research design. Following this procedure, increases in Latinx turnout in four of the markets (Austin, Dallas, El Paso, and Los Angeles) appear to be clearly statistically significant, while increases in two further markets (Washington, DC and Atlanta) are at least marginally significant.

In a further analysis of 18 different markets (Boston, Hartford, New York, Philadelphia, Raleigh, Orlando, Miami, Chicago, Houston, Harlingen/McAllen, San Antonio, Denver, Salt Lake City, Las Vegas, Phoenix, Tucson, Sacramento, San Diego, and San Francisco), seven markets showed increases in Latinx turnout of at least 5.8 percent relative to their synthetic controls from 2016-2018. These markets were (except for Miami), concentrated in Texas and California (Houston, Harlingen/McAllen, San Antonio, Sacramento, San Diego, and San Francisco). Increases were statistically significant in Houston and San Francisco. 3

Taken together, these analyses suggest that Spanish-language advertising spending likely contributes to increasing Latinx turnout, particularly in markets in California, Texas, and across the Southwest.

- To maximize comparability between precincts, media markets, and across elections, this analysis is limited to political advertising aired on behalf of candidates (both by campaigns and third parties) in Congressional races. ↩

- Abadie, A. and Gardeazabal, J., 2003. The economic costs of conflict: A case study of the Basque Country. American Economic Review, 93(1), pp.113-132. ↩

- These results should be interpreted more cautiously as markets in this analysis were selected based on substantive interest rather than experiencing a clear “treatment” of substantially increased Spanish language advertising spending (although all markets in this analysis did experience increased Spanish advertising spending in 2018).